Page 67 - CFA - Day 1 & 2 Course Notes

P. 67

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary

annuity, an annuity due, a perpetuity (PV

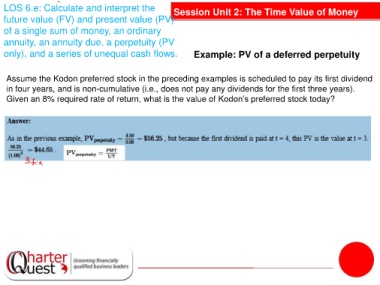

only), and a series of unequal cash flows. Example: PV of a deferred perpetuity

Assume the Kodon preferred stock in the preceding examples is scheduled to pay its first dividend

in four years, and is non-cumulative (i.e., does not pay any dividends for the first three years).

Given an 8% required rate of return, what is the value of Kodon’s preferred stock today?