Page 65 - CFA - Day 1 & 2 Course Notes

P. 65

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary

annuity, an annuity due, a perpetuity (PV

only), and a series of unequal cash flows.

FV of an Annuity Due PVAD = PVAO × (1 + I/Y)

Example: PV of an annuity due

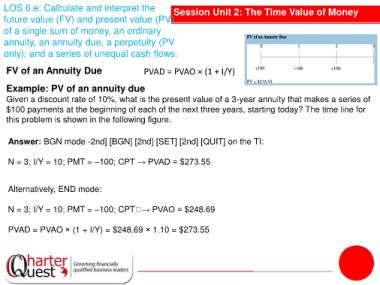

Given a discount rate of 10%, what is the present value of a 3-year annuity that makes a series of

$100 payments at the beginning of each of the next three years, starting today? The time line for

this problem is shown in the following figure.

Answer: BGN mode -2nd] [BGN] [2nd] [SET] [2nd] [QUIT] on the TI:

N = 3; I/Y = 10; PMT = –100; CPT → PVAD = $273.55

Alternatively, END mode:

N = 3; I/Y = 10; PMT = –100; CPT → PVAO = $248.69

PVAD = PVAO × (1 + I/Y) = $248.69 × 1.10 = $273.55