Page 24 - Capital Allowances Recoupments Part 1 (CTA)

P. 24

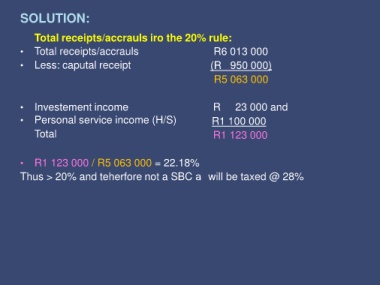

SOLUTION:

Total receipts/accrauls iro the 20% rule:

• Total receipts/accrauls R6 013 000

• Less: caputal receipt (R 950 000)

R5 063 000

• Investement income R 23 000 and

• Personal service income (H/S) R1 100 000

Total R1 123 000

• R1 123 000 / R5 063 000 = 22.18%

Thus > 20% and teherfore not a SBC a will be taxed @ 28%