Page 25 - Capital Allowances Recoupments Part 1 (CTA)

P. 25

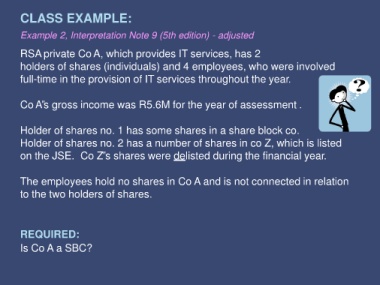

CLASS EXAMPLE:

Example 2, Interpretation Note 9 (5th edition) - adjusted

RSA private Co A, which provides IT services, has 2

holders of shares (individuals) and 4 employees, who were involved

full-time in the provision of IT services throughout the year.

Co A‟s gross income was R5.6M for the year of assessment .

Holder of shares no. 1 has some shares in a share block co.

Holder of shares no. 2 has a number of shares in co Z, which is listed

on the JSE. Co Z‟s shares were delisted during the financial year.

The employees hold no shares in Co A and is not connected in relation

to the two holders of shares.

REQUIRED:

Is Co A a SBC?