Page 245 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 245

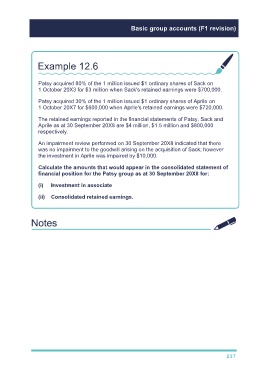

Basic group accounts (F1 revision)

Example 12.6

Patsy acquired 80% of the 1 million issued $1 ordinary shares of Sack on

1 October 20X3 for $3 million when Sack's retained earnings were $700,000.

Patsy acquired 30% of the 1 million issued $1 ordinary shares of Aprile on

1 October 20X7 for $600,000 when Aprile's retained earnings were $720,000.

The retained earnings reported in the financial statements of Patsy, Sack and

Aprile as at 30 September 20X8 are $4 million, $1.5 million and $800,000

respectively.

An impairment review performed on 30 September 20X8 indicated that there

was no impairment to the goodwill arising on the acquisition of Sack; however

the investment in Aprile was impaired by $10,000.

Calculate the amounts that would appear in the consolidated statement of

financial position for the Patsy group as at 30 September 20X8 for:

(i) Investment in associate

(ii) Consolidated retained earnings.

237