Page 259 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 259

Basic group accounts – goodwill and joint arrangements

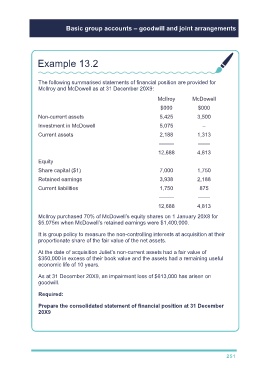

Example 13.2

The following summarised statements of financial position are provided for

McIlroy and McDowell as at 31 December 20X9:

McIlroy McDowell

$000 $000

Non-current assets 5,425 3,500

Investment in McDowell 5,075 –

Current assets 2,188 1,313

––––– ––––

12,688 4,813

Equity

Share capital ($1) 7,000 1,750

Retained earnings 3,938 2,188

Current liabilities 1,750 875

––––– ––––

12,688 4,813

McIlroy purchased 70% of McDowell’s equity shares on 1 January 20X8 for

$5.075m when McDowell’s retained earnings were $1,400,000.

It is group policy to measure the non-controlling interests at acquisition at their

proportionate share of the fair value of the net assets.

At the date of acquisition Juliet’s non-current assets had a fair value of

$350,000 in excess of their book value and the assets had a remaining useful

economic life of 10 years.

As at 31 December 20X9, an impairment loss of $613,000 has arisen on

goodwill.

Required:

Prepare the consolidated statement of financial position at 31 December

20X9

251