Page 319 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 319

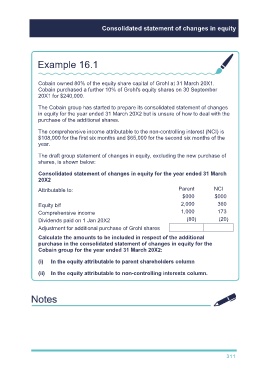

Consolidated statement of changes in equity

Example 16.1

Cobain owned 80% of the equity share capital of Grohl at 31 March 20X1.

Cobain purchased a further 10% of Grohl's equity shares on 30 September

20X1 for $240,000.

The Cobain group has started to prepare its consolidated statement of changes

in equity for the year ended 31 March 20X2 but is unsure of how to deal with the

purchase of the additional shares.

The comprehensive income attributable to the non-controlling interest (NCI) is

$108,000 for the first six months and $65,000 for the second six months of the

year.

The draft group statement of changes in equity, excluding the new purchase of

shares, is shown below:

Consolidated statement of changes in equity for the year ended 31 March

20X2

Attributable to: Parent NCI

$000 $000

Equity b/f 2,000 360

Comprehensive income 1,000 173

Dividends paid on 1 Jan 20X2 (80) (20)

Adjustment for additional purchase of Grohl shares

Calculate the amounts to be included in respect of the additional

purchase in the consolidated statement of changes in equity for the

Cobain group for the year ended 31 March 20X2:

(i) In the equity attributable to parent shareholders column

(ii) In the equity attributable to non-controlling interests column.

311