Page 348 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 348

Chapter 18

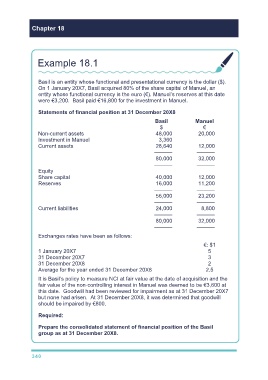

Example 18.1

Basil is an entity whose functional and presentational currency is the dollar ($).

On 1 January 20X7, Basil acquired 80% of the share capital of Manuel, an

entity whose functional currency is the euro (€). Manuel’s reserves at this date

were €3,200. Basil paid €16,800 for the investment in Manuel.

Statements of financial position at 31 December 20X8

Basil Manuel

$ €

Non-current assets 48,000 20,000

Investment in Manuel 3,360

Current assets 28,640 12,000

–––––– ––––––

80,000 32,000

–––––– ––––––

Equity

Share capital 40,000 12,000

Reserves 16,000 11,200

–––––– ––––––

56,000 23,200

–––––– ––––––

Current liabilities 24,000 8,800

–––––– ––––––

80,000 32,000

–––––– ––––––

Exchanges rates have been as follows:

€: $1

1 January 20X7 5

31 December 20X7 3

31 December 20X8 2

Average for the year ended 31 December 20X8 2.5

It is Basil’s policy to measure NCI at fair value at the date of acquisition and the

fair value of the non-controlling interest in Manuel was deemed to be €3,600 at

this date. Goodwill had been reviewed for impairment as at 31 December 20X7

but none had arisen. At 31 December 20X8, it was determined that goodwill

should be impaired by €800.

Required:

Prepare the consolidated statement of financial position of the Basil

group as at 31 December 20X8.

340