Page 350 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 350

Chapter 18

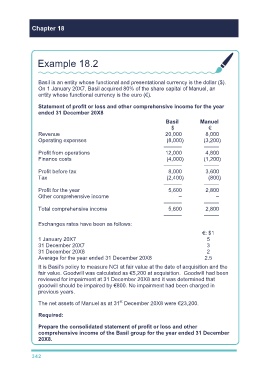

Example 18.2

Basil is an entity whose functional and presentational currency is the dollar ($).

On 1 January 20X7, Basil acquired 80% of the share capital of Manuel, an

entity whose functional currency is the euro (€).

Statement of profit or loss and other comprehensive income for the year

ended 31 December 20X8

Basil Manuel

$ €

Revenue 20,000 8,000

Operating expenses (8,000) (3,200)

–––––– –––––

Profit from operations 12,000 4,800

Finance costs (4,000) (1,200)

–––––– –––––

Profit before tax 8,000 3,600

Tax (2,400) (800)

–––––– –––––

Profit for the year 5,600 2,800

Other comprehensive income – –

–––––– –––––

Total comprehensive income 5,600 2,800

–––––– –––––

Exchanges rates have been as follows:

€: $1

1 January 20X7 5

31 December 20X7 3

31 December 20X8 2

Average for the year ended 31 December 20X8 2.5

It is Basil’s policy to measure NCI at fair value at the date of acquisition and the

fair value. Goodwill was calculated as €5,200 at acquisition. Goodwill had been

reviewed for impairment at 31 December 20X8 and it was determined that

goodwill should be impaired by €800. No impairment had been charged in

previous years.

st

The net assets of Manuel as at 31 December 20X8 were €23,200.

Required:

Prepare the consolidated statement of profit or loss and other

comprehensive income of the Basil group for the year ended 31 December

20X8.

342