Page 362 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 362

Chapter 19

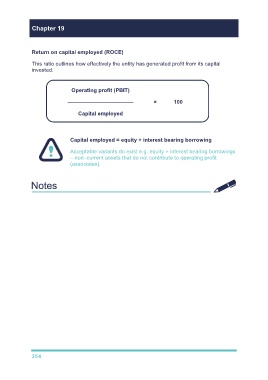

Return on capital employed (ROCE)

This ratio outlines how effectively the entity has generated profit from its capital

invested.

Operating profit (PBIT)

–––––––––––––––––––––– × 100

Capital employed

Capital employed = equity + interest bearing borrowing

Acceptable variants do exist e.g. equity + interest bearing borrowings

– non–current assets that do not contribute to operating profit

(associates).

TUTOR GUIDANCE

Common reasons for movements in ROCE:

Caused by movements in OP% (see above) or asset turnover

If not in line with OP% movements, movement caused by asset turnover (how

well entity generates revenues from its NCAs)

e.g.

revaluations

investments in PPE near end of year – no time for asset to generate

profits

changes in leases.

354