Page 434 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 434

Chapter 20

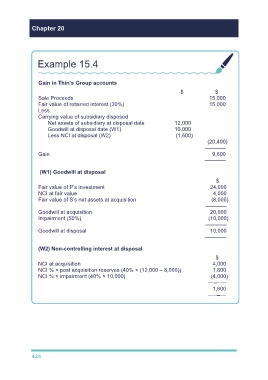

Example 15.4

Gain in Thin’s Group accounts

$ $

Sale Proceeds 15,000

Fair value of retained interest (30%) 15,000

Less

Carrying value of subsidiary disposed

Net assets of subsidiary at disposal date 12,000

Goodwill at disposal date (W1) 10,000

Less NCI at disposal (W2) (1,600)

(20,400)

–––––––

Gain 9,600

–––––––

(W1) Goodwill at disposal

$

Fair value of P’s investment 24,000

NCI at fair value 4,000

Fair value of S’s net assets at acquisition (8,000)

–––––––

Goodwill at acquisition 20,000

Impairment (50%) (10,000)

–––––––

Goodwill at disposal 10,000

–––––––

(W2) Non-controlling interest at disposal

$

NCI at acquisition 4,000

NCI % × post acquisition reserves (40% × (12,000 – 8,000)) 1,600

NCI % × impairment (40% × 10,000) (4,000)

––––––

1,600

––––––

426