Page 429 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 429

Answers

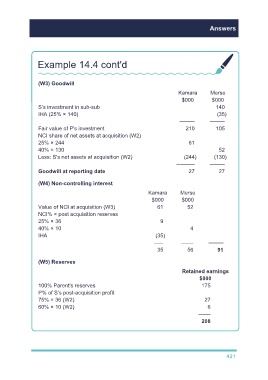

Example 14.4 cont'd

(W3) Goodwill

Kamara Merse

$000 $000

S’s investment in sub-sub 140

IHA (25% × 140) (35)

––––– –––––

Fair value of P's investment 210 105

NCI share of net assets at acquisition (W2)

25% × 244 61

40% × 130 52

Less: S's net assets at acquisition (W2) (244) (130)

–––––– –––––

Goodwill at reporting date 27 27

(W4) Non-controlling interest

Kamara Merse

$000 $000

Value of NCI at acquisition (W3) 61 52

NCI% × post acquisition reserves

25% × 36 9

40% × 10 4

IHA (35)

––– –––– –––––

35 56 91

(W5) Reserves

Retained earnings

$000

100% Parent's reserves 175

P% of S’s post-acquisition profit

75% × 36 (W2) 27

60% × 10 (W2) 6

––––

208

421