Page 491 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 491

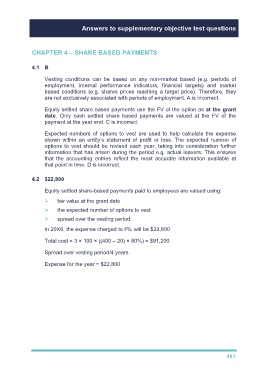

Answers to supplementary objective test questions

CHAPTER 4 – SHARE BASED PAYMENTS

4.1 B

Vesting conditions can be based on any non-market based (e.g. periods of

employment, internal performance indicators, financial targets) and market

based conditions (e.g. shares prices reaching a target price). Therefore, they

are not exclusively associated with periods of employment. A is incorrect.

Equity settled share based payments use the FV of the option as at the grant

date. Only cash settled share based payments are valued at the FV of the

payment at the year end. C is incorrect

Expected numbers of options to vest are used to help calculate the expense

shown within an entity’s statement of profit or loss. The expected number of

options to vest should be revised each year, taking into consideration further

information that has arisen during the period e.g. actual leavers. This ensures

that the accounting entries reflect the most accurate information available at

that point in time. D is incorrect.

4.2 $22,800

Equity settled share-based payments paid to employees are valued using:

fair value at the grant date

the expected number of options to vest

spread over the vesting period.

In 20X6, the expense charged to P/L will be $22,800

Total cost = 3 × 100 × ((400 – 20) × 80%) = $91,200

Spread over vesting period/4 years

Expense for the year = $22,800

483