Page 496 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 496

F2: Advanced Financial Reporting

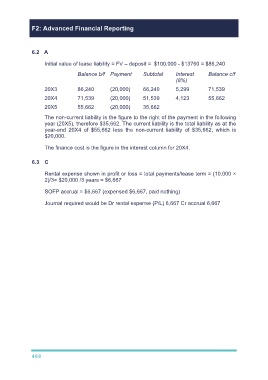

6.2 A

Initial value of lease liability = FV – deposit = $100,000 - $13760 = $86,240

Balance b/f Payment Subtotal Interest Balance c/f

(8%)

20X3 86,240 (20,000) 66,240 5,299 71,539

20X4 71,539 (20,000) 51,539 4,123 55,662

20X5 55,662 (20,000) 35,662

The non-current liability is the figure to the right of the payment in the following

year (20X5), therefore $35,662. The current liability is the total liability as at the

year-end 20X4 of $55,662 less the non-current liability of $35,662, which is

$20,000.

The finance cost is the figure in the interest column for 20X4.

6.3 C

Rental expense shown in profit or loss = total payments/lease term = (10,000 ×

2)/3= $20,000 /3 years = $6,667

SOFP accrual = $6,667 (expensed $6,667, paid nothing)

Journal required would be Dr rental expense (P/L) 6,667 Cr accrual 6,667

488