Page 499 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 499

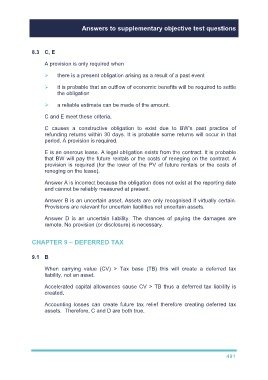

Answers to supplementary objective test questions

8.3 C, E

A provision is only required when

there is a present obligation arising as a result of a past event

it is probable that an outflow of economic benefits will be required to settle

the obligation

a reliable estimate can be made of the amount.

C and E meet these criteria.

C causes a constructive obligation to exist due to BW’s past practice of

refunding returns within 30 days. It is probable some returns will occur in that

period. A provision is required.

E is an onerous lease. A legal obligation exists from the contract. It is probable

that BW will pay the future rentals or the costs of reneging on the contract. A

provision is required (for the lower of the PV of future rentals or the costs of

reneging on the lease).

Answer A is incorrect because the obligation does not exist at the reporting date

and cannot be reliably measured at present.

Answer B is an uncertain asset. Assets are only recognised if virtually certain.

Provisions are relevant for uncertain liabilities not uncertain assets.

Answer D is an uncertain liability. The chances of paying the damages are

remote. No provision (or disclosure) is necessary.

CHAPTER 9 – DEFERRED TAX

9.1 B

When carrying value (CV) > Tax base (TB) this will create a deferred tax

liability, not an asset.

Accelerated capital allowances cause CV > TB thus a deferred tax liability is

created.

Accounting losses can create future tax relief therefore creating deferred tax

assets. Therefore, C and D are both true.

491