Page 503 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 503

Answers to supplementary objective test questions

CHAPTER 12 – BASIC GROUP ACCOUNTS

12.1 B

The fact that unanimous consent is required would suggest that there is no

control over the investee.

12.2 A

The profit on the sale is $900,000 × 20/120 = $150,000.

As 80% of the goods have been sold on to third parties, 20% remains in

inventory at the year end. Unrealised profits only arise on goods remaining in

inventory at the year end, so the unrealised profit is $150,000 × 20% = $30,000.

12.3 D

PUP adjustment = $7,800 × 20% × 60% = $936. This is deducted from

inventory.

As the subsidiary, Shadow, was the seller, the PUP is split between NCI and

parent shareholders.

75% × $936 = $702 is deducted from consolidated retained earnings. 25% ×

$936 = $234 is deducted from NCI.

12.4 D

LS is a subsidiary of CK. The assets and liabilities of CK and LS should be

100% consolidated within the group accounts.

Intragroup outstanding balances must be eliminated from the group accounts.

CK owes $50,000 to LS at the year-end. This will have already been reduced by

the payment of $10,000 before the year end. LS must, therefore, have $60,000

in its receivables owed from CK at the year-end as the cash is in transit.

Cash in transit from intragroup transactions should be treated in the group

accounts as if it has already been received by LS as at the year end. LS will

Dr Cash $10,000 Cr Receivables $10,000. This will leave $50,000 receivables

outstanding in LS’s account. The intragroup outstanding balances can now be

cancelled out removing $50,000 from receivables and payables. The group

balances are given as follows:

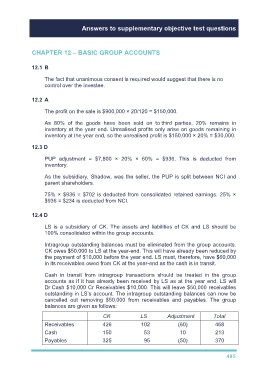

CK LS Adjustment Total

Receivables 426 102 (60) 468

Cash 150 53 10 213

Payables 325 95 (50) 370

495