Page 506 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 506

F2: Advanced Financial Reporting

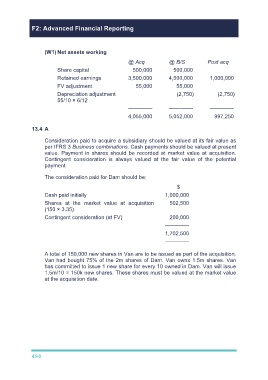

(W1) Net assets working

@ Acq @ B/S Post acq

Share capital 500,000 500,000

Retained earnings 3,500,000 4,500,000 1,000,000

FV adjustment 55,000 55,000

Depreciation adjustment (2,750) (2,750)

55/10 × 6/12

–––––––– –––––––– ––––––––

4,055,000 5,052,000 997,250

13.4 A

Consideration paid to acquire a subsidiary should be valued at its fair value as

per IFRS 3 Business combinations. Cash payments should be valued at present

value. Payment in shares should be recorded at market value at acquisition.

Contingent consideration is always valued at the fair value of the potential

payment.

The consideration paid for Dam should be:

$

Cash paid initially 1,000,000

Shares at the market value at acquisition 502,500

(150 × 3.35)

Contingent consideration (at FV) 200,000

––––––––

1,702,500

––––––––

A total of 150,000 new shares in Van are to be issued as part of the acquisition.

Van had bought 75% of the 2m shares of Dam. Van owns 1.5m shares. Van

has committed to issue 1 new share for every 10 owned in Dam. Van will issue

1.5m/10 = 150k new shares. These shares must be valued at the market value

at the acquisition date.

498