Page 511 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 511

Answers to supplementary objective test questions

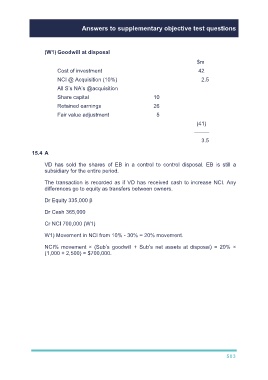

(W1) Goodwill at disposal

$m

Cost of investment 42

NCI @ Acquisition (10%) 2.5

All S’s NA’s @acquisition

Share capital 10

Retained earnings 26

Fair value adjustment 5

(41)

–––––

3.5

15.4 A

VD has sold the shares of EB in a control to control disposal. EB is still a

subsidiary for the entire period.

The transaction is recorded as if VD has received cash to increase NCI. Any

differences go to equity as transfers between owners.

Dr Equity 335,000 β

Dr Cash 365,000

Cr NCI 700,000 (W1)

W1) Movement in NCI from 10% - 30% = 20% movement.

NCI% movement × (Sub’s goodwill + Sub’s net assets at disposal) = 20% ×

(1,000 + 2,500) = $700,000.

503