Page 508 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 508

F2: Advanced Financial Reporting

14.2 B, E

Splash is a 60% directly controlled subsidiary. Sauna is an indirectly controlled

sub-subsidiary with an effective shareholding of 60% × 70% = 42%. This gives

a NCI % for Sauna of 58%, not 30%.

The effective date of ownership of a sub-sub is the later of the date the parent

acquired the sub or the date the sub acquired the sub-sub. In this case Splash

(the sub) is consolidated from 1st June and Sauna is consolidated from

31st August. Option E shows this the opposite way round.

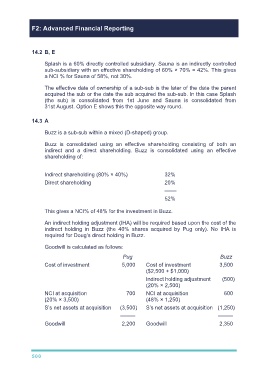

14.3 A

Buzz is a sub-sub within a mixed (D-shaped) group.

Buzz is consolidated using an effective shareholding consisting of both an

indirect and a direct shareholding. Buzz is consolidated using an effective

shareholding of:

Indirect shareholding (80% × 40%) 32%

Direct shareholding 20%

––––

52%

This gives a NCI% of 48% for the investment in Buzz.

An indirect holding adjustment (IHA) will be required based upon the cost of the

indirect holding in Buzz (the 40% shares acquired by Pug only). No IHA is

required for Doug’s direct holding in Buzz.

Goodwill is calculated as follows:

Pug Buzz

Cost of investment 5,000 Cost of investment 3,500

($2,500 + $1,000)

Indirect holding adjustment (500)

(20% × 2,500)

NCI at acquisition 700 NCI at acquisition 600

(20% × 3,500) (48% × 1,250)

S’s net assets at acquisition (3,500) S’s net assets at acquisition (1,250)

––––– –––––

Goodwill 2,200 Goodwill 2,350

500