Page 504 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 504

F2: Advanced Financial Reporting

12.5 B

The dividend would not have affected Simon’s statement of profit or loss.

Dividends paid are taken out of retained earnings and do not impact profits. No

adjustment needs to be made for the dividend paid from Paul’s share of

Simon’s profits.

The profit needs to be time-apportioned for the six months of ownership, with

the impairment of $15,000 then deducted.

Share of profits from associate = 40% x ($450,000 x 6/12) – $15,000 = $75,000

12.6 C

Poppy owns 30% of Sunflower’s shares, which is 60,000 shares (30% of

Sunflower’s 200,000 shares).

As Poppy gave 1 share away for every 4 purchased, Poppy gave 15,000 shares

away. These had a market value of $5 and were worth $75,000.

After that Poppy must include 30% of Sunflower’s post acquisition movement in

net assets. Sunflower has made a post-acquisition loss of $50,000 (net assets

at acquisition were $600,000 [$200,000 share capital plus $400,000 retained

earnings] and net assets at 31 December 20X6 were $550,000). Therefore

Poppy’s share is a $15,000 loss (30%).

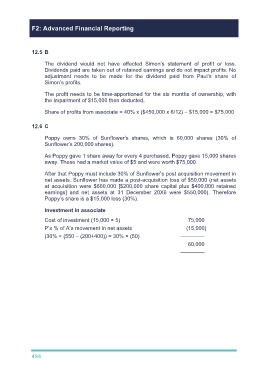

Investment in associate

Cost of investment (15,000 × 5) 75,000

P’s % of A’s movement in net assets (15,000)

(30% × (550 – (200+400)) = 30% × (50) ––––––––

60,000

––––––––

496