Page 500 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 500

F2: Advanced Financial Reporting

9.2 B

Entertaining expenses create permanent differences between the accounting

and tax treatments. Entertaining expenses will be included within the profit or

loss account as incurred. They are not deductible for tax purposes.

Deferred tax is created by temporary differences not permanent differences.

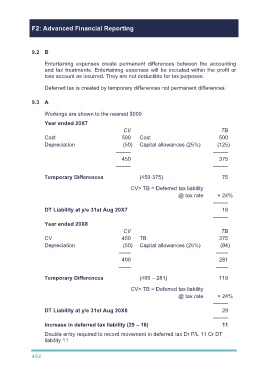

9.3 A

Workings are shown to the nearest $000

Year ended 20X7

CV TB

Cost 500 Cost 500

Depreciation (50) Capital allowances (25%) (125)

––––– –––––

450 375

––––– –––––

Temporary Differences (450-375) 75

CV> TB = Deferred tax liability

@ tax rate × 24%

–––––

DT Liability at y/e 31st Aug 20X7 18

–––––

Year ended 20X8

CV TB

CV 450 TB 375

Depreciation (50) Capital allowances (25%) (94)

–––– ––––

400 281

–––– ––––

Temporary Differences (400 – 281) 119

CV> TB = Deferred tax liability

@ tax rate × 24%

–––––

DT Liability at y/e 31st Aug 20X8 29

–––––

Increase in deferred tax liability (29 – 18) 11

Double entry required to record movement in deferred tax Dr P/L 11 Cr DT

liability 11

492