Page 497 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 497

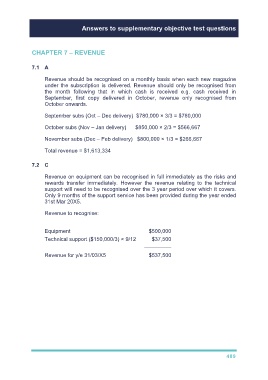

Answers to supplementary objective test questions

CHAPTER 7 – REVENUE

7.1 A

Revenue should be recognised on a monthly basis when each new magazine

under the subscription is delivered. Revenue should only be recognised from

the month following that in which cash is received e.g. cash received in

September, first copy delivered in October, revenue only recognised from

October onwards.

September subs (Oct – Dec delivery) $780,000 × 3/3 = $780,000

October subs (Nov – Jan delivery) $850,000 × 2/3 = $566,667

November subs (Dec – Feb delivery) $800,000 × 1/3 = $266,667

Total revenue = $1,613,334

7.2 C

Revenue on equipment can be recognised in full immediately as the risks and

rewards transfer immediately. However the revenue relating to the technical

support will need to be recognised over the 3 year period over which it covers.

Only 9 months of the support service has been provided during the year ended

31st Mar 20X5.

Revenue to recognise:

Equipment $500,000

Technical support ($150,000/3) × 9/12 $37,500

–––––––––

Revenue for y/e 31/03/X5 $537,500

489