Page 505 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 505

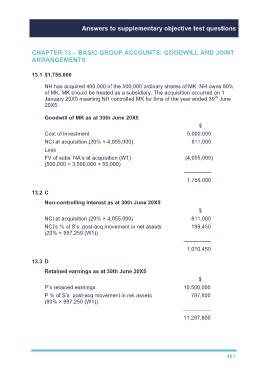

Answers to supplementary objective test questions

CHAPTER 13 – BASIC GROUP ACCOUNTS: GOODWILL AND JOINT

ARRANGEMENTS

13.1 $1,756,000

NH has acquired 400,000 of the 500,000 ordinary shares of MK. NH owns 80%

of MK. MK should be treated as a subsidiary. The acquisition occurred on 1

th

January 20X5 meaning NH controlled MK for 6ms of the year ended 30 June

20X5.

Goodwill of MK as at 30th June 20X5

$

Cost of investment 5,000,000

NCI at acquisition (20% × 4,055,000) 811,000

Less

FV of subs’ NA’s at acquisition (W1) (4,055,000)

(500,000 + 3,500,000 + 55,000)

–––––––––

1,756,000

13.2 C

Non-controlling interest as at 30th June 20X5

$

NCI at acquisition (20% × 4,055,000) 811,000

NCI’s % of S’s post-acq movement in net assets 199,450

(20% × 997,250 (W1))

–––––––––

1,010,450

13.3 D

Retained earnings as at 30th June 20X5

$

P’s retained earnings 10,500,000

P % of S’s post-acq movement in net assets 797,800

(80% × 997,250 (W1))

–––––––––

11,297,800

497