Page 512 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 512

F2: Advanced Financial Reporting

CHAPTER 16 – CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

16.1 D

The amount attributable to parents shareholders = 100% of Parents total

comprehensive income + 100% of S’s total comprehensive income – NCI share

of S’s total comprehensive income. As the acquisition of Snoopy occurred 6

months into the year, only the total comprehensive income earned by Snoopy

since acquisition is consolidated.

= 310 + (220 × 6/12) – (30% × (220 × 6/12)

= 387

Non-controlling interest share of total comprehensive income = 30% × (220 ×

6/12) = 33

Workings are given in $000s.

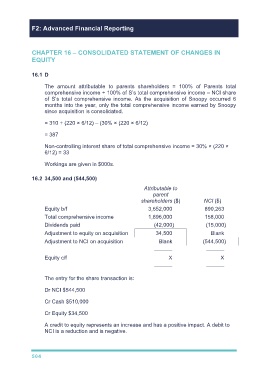

16.2 34,500 and (544,500)

Attributable to

parent

shareholders ($) NCI ($)

Equity b/f 3,652,000 890,263

Total comprehensive income 1,896,000 158,000

Dividends paid (42,000) (15,000)

Adjustment to equity on acquisition 34,500 Blank

Adjustment to NCI on acquisition Blank (544,500)

–––––– ––––––

Equity c/f X X

–––––– ––––––

The entry for the share transaction is:

Dr NCI $544,500

Cr Cash $510,000

Cr Equity $34,500

A credit to equity represents an increase and has a positive impact. A debit to

NCI is a reduction and is negative.

504