Page 516 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 516

F2: Advanced Financial Reporting

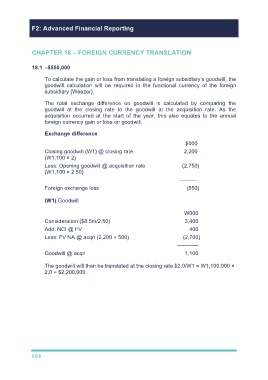

CHAPTER 18 – FOREIGN CURRENCY TRANSLATION

18.1 –$550,000

To calculate the gain or loss from translating a foreign subsidiary’s goodwill, the

goodwill calculation will be required in the functional currency of the foreign

subsidiary (Weezer).

The total exchange difference on goodwill is calculated by comparing the

goodwill at the closing rate to the goodwill at the acquisition rate. As the

acquisition occurred at the start of the year, this also equates to the annual

foreign currency gain or loss on goodwill.

Exchange difference

$000

Closing goodwill (W1) @ closing rate 2,200

(W1,100 × 2)

Less: Opening goodwill @ acquisition rate (2,750)

(W1,100 × 2.50)

––––––

Foreign exchange loss (550)

(W1) Goodwill

W000

Consideration ($8.5m/2.50) 3,400

Add: NCI @ FV 400

Less: FV NA @ acqn (2,200 + 500) (2,700)

–––––––

Goodwill @ acqn 1,100

The goodwill will then be translated at the closing rate $2.0/W1 = W1,100,000 ×

2.0 = $2,200,000.

508