Page 50 - F6 Slides (CGT,TT,ET AND PT)

P. 50

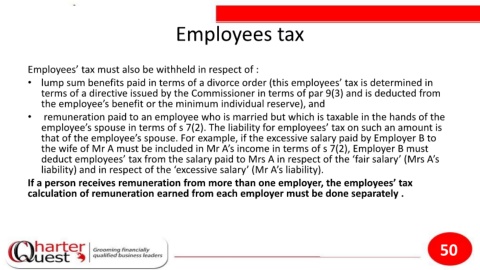

Employees tax

Employees’ tax must also be withheld in respect of :

• lump sum benefits paid in terms of a divorce order (this employees’ tax is determined in

terms of a directive issued by the Commissioner in terms of par 9(3) and is deducted from

the employee’s benefit or the minimum individual reserve), and

• remuneration paid to an employee who is married but which is taxable in the hands of the

employee’s spouse in terms of s 7(2). The liability for employees’ tax on such an amount is

that of the employee’s spouse. For example, if the excessive salary paid by Employer B to

the wife of Mr A must be included in Mr A’s income in terms of s 7(2), Employer B must

deduct employees’ tax from the salary paid to Mrs A in respect of the ‘fair salary’ (Mrs A’s

liability) and in respect of the ‘excessive salary’ (Mr A’s liability).

If a person receives remuneration from more than one employer, the employees’ tax

calculation of remuneration earned from each employer must be done separately .

50