Page 51 - F6 Slides (CGT,TT,ET AND PT)

P. 51

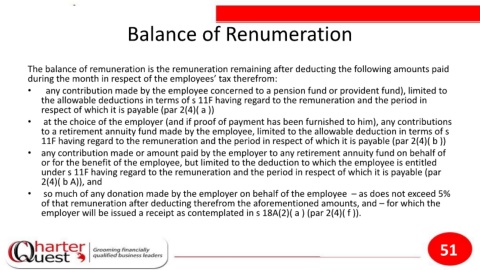

Balance of Renumeration

The balance of remuneration is the remuneration remaining after deducting the following amounts paid

during the month in respect of the employees’ tax therefrom:

• any contribution made by the employee concerned to a pension fund or provident fund), limited to

the allowable deductions in terms of s 11F having regard to the remuneration and the period in

respect of which it is payable (par 2(4)( a ))

• at the choice of the employer (and if proof of payment has been furnished to him), any contributions

to a retirement annuity fund made by the employee, limited to the allowable deduction in terms of s

11F having regard to the remuneration and the period in respect of which it is payable (par 2(4)( b ))

• any contribution made or amount paid by the employer to any retirement annuity fund on behalf of

or for the benefit of the employee, but limited to the deduction to which the employee is entitled

under s 11F having regard to the remuneration and the period in respect of which it is payable (par

2(4)( b A)), and

• so much of any donation made by the employer on behalf of the employee – as does not exceed 5%

of that remuneration after deducting therefrom the aforementioned amounts, and – for which the

employer will be issued a receipt as contemplated in s 18A(2)( a ) (par 2(4)( f )).

51