Page 119 - BA2 Integrated Workbook STUDENT 2018

P. 119

Budgeting

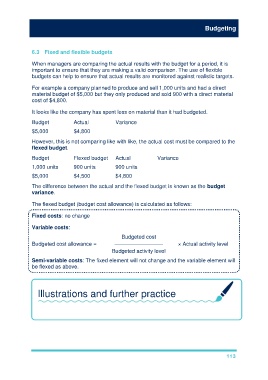

6.3 Fixed and flexible budgets

When managers are comparing the actual results with the budget for a period, it is

important to ensure that they are making a valid comparison. The use of flexible

budgets can help to ensure that actual results are monitored against realistic targets.

For example a company planned to produce and sell 1,000 units and had a direct

material budget of $5,000 but they only produced and sold 900 with a direct material

cost of $4,800.

It looks like the company has spent less on material than it had budgeted.

Budget Actual Variance

$5,000 $4,800 $200 favourable

However, this is not comparing like with like, the actual cost must be compared to the

flexed budget.

Budget Flexed budget Actual Variance

1,000 units 900 units 900 units

$5,000 $4,500 $4,800 $300 adverse

The difference between the actual and the flexed budget is known as the budget

variance.

The flexed budget (budget cost allowance) is calculated as follows:

Fixed costs: no change

Variable costs:

Budgeted cost

Budgeted cost allowance = ————————— × Actual activity level

Budgeted activity level

Semi-variable costs: The fixed element will not change and the variable element will

be flexed as above.

Illustrations and further practice

Go over illustration 3 or work through TYU 6

113