Page 295 - BA2 Integrated Workbook STUDENT 2018

P. 295

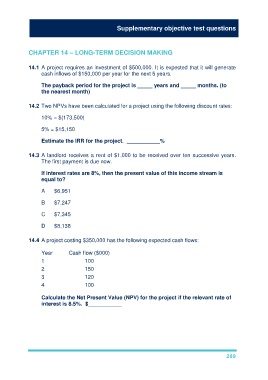

Supplementary objective test questions

CHAPTER 14 – LONG-TERM DECISION MAKING

14.1 A project requires an investment of $500,000. It is expected that it will generate

cash inflows of $150,000 per year for the next 5 years.

The payback period for the project is _____ years and _____ months. (to

the nearest month)

14.2 Two NPVs have been calculated for a project using the following discount rates:

10% = $(173,500)

5% = $15,150

Estimate the IRR for the project. ___________%

14.3 A landlord receives a rent of $1,000 to be received over ten successive years.

The first payment is due now.

If interest rates are 8%, then the present value of this income stream is

equal to?

A $6,951

B $7,247

C $7,345

D $8,138

14.4 A project costing $350,000 has the following expected cash flows:

Year Cash flow ($000)

1 100

2 150

3 120

4 100

Calculate the Net Present Value (NPV) for the project if the relevant rate of

interest is 8.5%. $___________

289