Page 12 - PowerPoint Presentation

P. 12

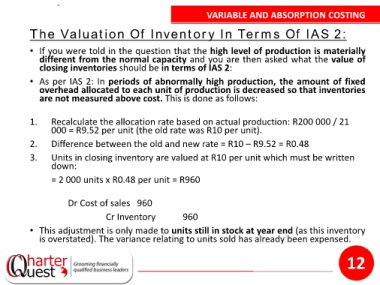

VARIABLE AND ABSORPTION COSTING

The Valuation Of Inventory In Terms Of IAS 2:

• If you were told in the question that the high level of production is materially

different from the normal capacity and you are then asked what the value of

closing inventories should be in terms of IAS 2:

• As per IAS 2: In periods of abnormally high production, the amount of fixed

overhead allocated to each unit of production is decreased so that inventories

are not measured above cost. This is done as follows:

1. Recalculate the allocation rate based on actual production: R200 000 / 21

000 = R9.52 per unit (the old rate was R10 per unit).

2. Difference between the old and new rate = R10 – R9.52 = R0.48

3. Units in closing inventory are valued at R10 per unit which must be written

down:

= 2 000 units x R0.48 per unit = R960

Dr Cost of sales 960

Cr Inventory 960

• This adjustment is only made to units still in stock at year end (as this inventory

is overstated). The variance relating to units sold has already been expensed.

12