Page 184 - Microsoft Word - 00 - Prelims.docx

P. 184

Chapter 15

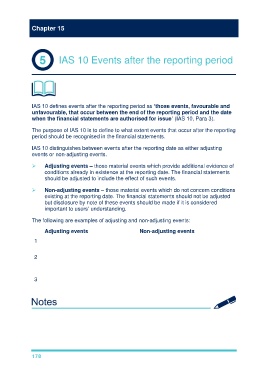

IAS 10 Events after the reporting period

IAS 10 defines events after the reporting period as ‘those events, favourable and

unfavourable, that occur between the end of the reporting period and the date

when the financial statements are authorised for issue’ (IAS 10, Para 3).

The purpose of IAS 10 is to define to what extent events that occur after the reporting

period should be recognised in the financial statements.

IAS 10 distinguishes between events after the reporting date as either adjusting

events or non-adjusting events.

Adjusting events – those material events which provide additional evidence of

conditions already in existence at the reporting date. The financial statements

should be adjusted to include the effect of such events.

Non-adjusting events – those material events which do not concern conditions

existing at the reporting date. The financial statements should not be adjusted

but disclosure by note of these events should be made if it is considered

important to users’ understanding.

The following are examples of adjusting and non-adjusting events:

Adjusting events Non-adjusting events

1 Discovery of errors or fraud that Fluctuations in tax/exchange rates

occurred during the reporting period

2 Resolution of an insurance claim or Issue of shares

court case that confirms an obligation

at the reporting date

3 Major customers going into Fire or flood after the reporting date

liquidation

178