Page 210 - Microsoft Word - 00 - Prelims.docx

P. 210

Chapter 17

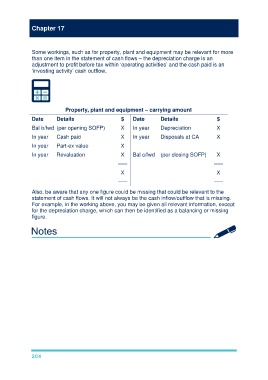

Some workings, such as for property, plant and equipment may be relevant for more

than one item in the statement of cash flows – the depreciation charge is an

adjustment to profit before tax within ‘operating activities’ and the cash paid is an

‘investing activity’ cash outflow.

Property, plant and equipment – carrying amount

Date Details $ Date Details $

Bal b/fwd (per opening SOFP) X In year Depreciation X

In year Cash paid X In year Disposals at CA X

In year Part-ex value X

In year Revaluation X Bal c/fwd (per closing SOFP) X

––– –––

X X

––– –––

Also, be aware that any one figure could be missing that could be relevant to the

statement of cash flows. It will not always be the cash inflow/outflow that is missing.

For example, in the working above, you may be given all relevant information, except

for the depreciation charge, which can then be identified as a balancing or missing

figure.

204