Page 43 - Microsoft Word - 00 - Prelims.docx

P. 43

Ledger accounting and double-entry bookkeeping

3.4 Cash book

The term ‘cash book’ dates back to the days when business entities dealt only in

cash transactions (i.e. notes and coins). Nowadays business entities rarely deal in

cash unless they are retail businesses, so the term ‘cash book’ refers to any book

that records monies received and paid that will pass through the bank account.

Many business entities have two distinct cash books – a cash payments book and a

cash receipts book.

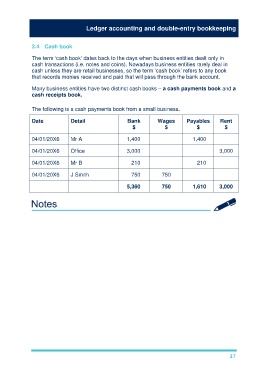

The following is a cash payments book from a small business.

Date Detail Bank Wages Payables Rent

$ $ $ $

04/01/20X6 Mr A 1,400 1,400

04/01/20X6 Office 3,000 3,000

04/01/20X6 Mr B 210 210

04/01/20X6 J Smith 750 750

5,360 750 1,610 3,000

37