Page 84 - Microsoft Word - 00 - Prelims.docx

P. 84

Chapter 6

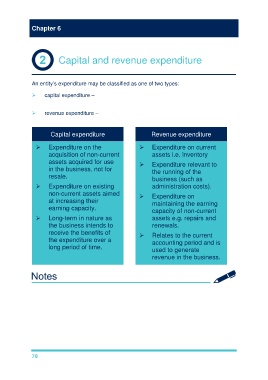

Capital and revenue expenditure

An entity’s expenditure may be classified as one of two types:

capital expenditure – expenditure likely to increase the future earning capability

of the entity, or

revenue expenditure – expenditure associated with maintaining the entity’s

present earning capability.

Capital expenditure Revenue expenditure

Expenditure on the Expenditure on current

acquisition of non-current assets i.e. inventory

assets acquired for use

Expenditure relevant to

in the business, not for the running of the

resale. business (such as

Expenditure on existing administration costs).

non-current assets aimed Expenditure on

at increasing their maintaining the earning

earning capacity.

capacity of non-current

Long-term in nature as assets e.g. repairs and

the business intends to renewals.

receive the benefits of

Relates to the current

the expenditure over a accounting period and is

long period of time. used to generate

revenue in the business.

78