Page 85 - Microsoft Word - 00 - Prelims.docx

P. 85

Non-current assets: acquisition and depreciation

Tangible non-current assets

3.1 Acquisition of a tangible non-current asset

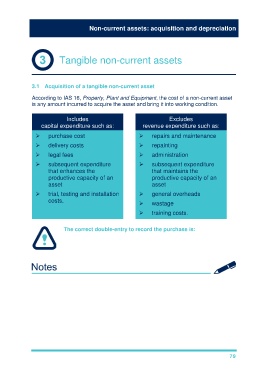

According to IAS 16, Property, Plant and Equipment, the cost of a non-current asset

is any amount incurred to acquire the asset and bring it into working condition.

Includes Excludes

capital expenditure such as: revenue expenditure such as:

purchase cost repairs and maintenance

delivery costs repainting

legal fees administration

subsequent expenditure subsequent expenditure

that enhances the that maintains the

productive capacity of an productive capacity of an

asset asset

trial, testing and installation general overheads

costs. wastage

training costs.

The correct double-entry to record the purchase is:

Debit Non-current asset account

Credit Cash/bank/payable account

79