Page 44 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 44

Session Unit 9:

33. Financial Statement Analysis: Applications

LOS 33.e: Explain appropriate analyst adjustments to a company’s financial statements to

facilitate comparison with another company., p.325

These arise from differences in accounting methods, or need to adjust from US GAAP to IFRS

to IFRAS to US GAAP!

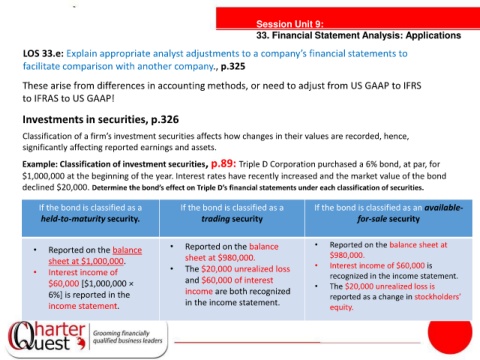

Investments in securities, p.326

Classification of a firm’s investment securities affects how changes in their values are recorded, hence,

tanties

significantly affecting reported earnings and assets.

Example: Classification of investment securities, p.89: Triple D Corporation purchased a 6% bond, at par, for

$1,000,000 at the beginning of the year. Interest rates have recently increased and the market value of the bond

declined $20,000. Determine the bond’s effect on Triple D’s financial statements under each classification of securities.

If the bond is classified as a If the bond is classified as a If the bond is classified as an available-

held-to-maturity security. trading security for-sale security

• Reported on the balance • Reported on the balance • Reported on the balance sheet at

sheet at $980,000. $980,000.

sheet at $1,000,000. • Interest income of $60,000 is

• Interest income of • The $20,000 unrealized loss recognized in the income statement.

$60,000 [$1,000,000 × and $60,000 of interest • The $20,000 unrealized loss is

6%] is reported in the income are both recognized reported as a change in stockholders’

income statement. in the income statement. equity.