Page 31 - 5.3 i. Taxation ITC Summarised Notes part 2

P. 31

ITC EXAM PREP

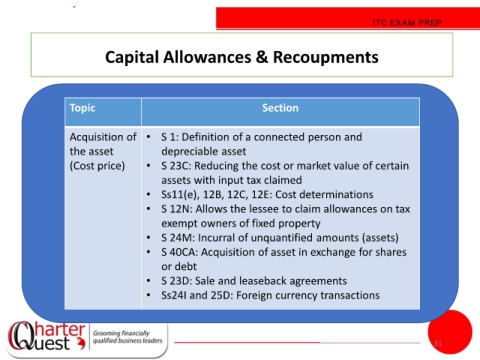

Capital Allowances & Recoupments

Topic Section

Acquisition of • S 1: Definition of a connected person and

the asset depreciable asset

(Cost price) • S 23C: Reducing the cost or market value of certain

assets with input tax claimed

• Ss11(e), 12B, 12C, 12E: Cost determinations

• S 12N: Allows the lessee to claim allowances on tax

exempt owners of fixed property

• S 24M: Incurral of unquantified amounts (assets)

• S 40CA: Acquisition of asset in exchange for shares

or debt

• S 23D: Sale and leaseback agreements

• Ss24I and 25D: Foreign currency transactions

31