Page 33 - 5.3 i. Taxation ITC Summarised Notes part 2

P. 33

ITC EXAM PREP

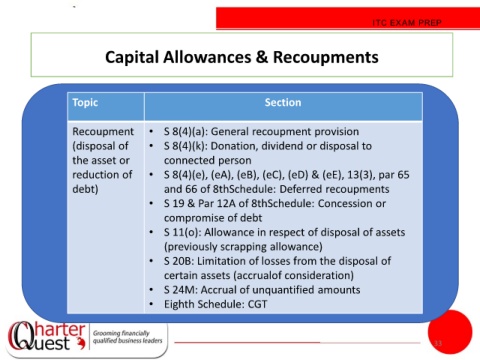

Capital Allowances & Recoupments

Topic Section

Recoupment • S 8(4)(a): General recoupment provision

(disposal of • S 8(4)(k): Donation, dividend or disposal to

the asset or connected person

reduction of • S 8(4)(e), (eA), (eB), (eC), (eD) & (eE), 13(3), par 65

debt) and 66 of 8thSchedule: Deferred recoupments

• S 19 & Par 12A of 8thSchedule: Concession or

compromise of debt

• S 11(o): Allowance in respect of disposal of assets

(previously scrapping allowance)

• S 20B: Limitation of losses from the disposal of

certain assets (accrualof consideration)

• S 24M: Accrual of unquantified amounts

• Eighth Schedule: CGT

33