Page 10 - PowerPoint Presentation

P. 10

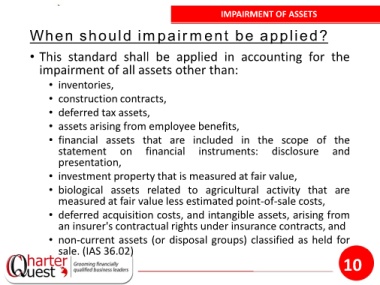

IMPAIRMENT OF ASSETS

When should impairment be applied?

• This standard shall be applied in accounting for the

impairment of all assets other than:

• inventories,

• construction contracts,

• deferred tax assets,

• assets arising from employee benefits,

• financial assets that are included in the scope of the

statement on financial instruments: disclosure and

presentation,

• investment property that is measured at fair value,

• biological assets related to agricultural activity that are

measured at fair value less estimated point-of-sale costs,

• deferred acquisition costs, and intangible assets, arising from

an insurer's contractual rights under insurance contracts, and

• non-current assets (or disposal groups) classified as held for

sale. (IAS 36.02)

10