Page 141 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 141

Accounting for overheads

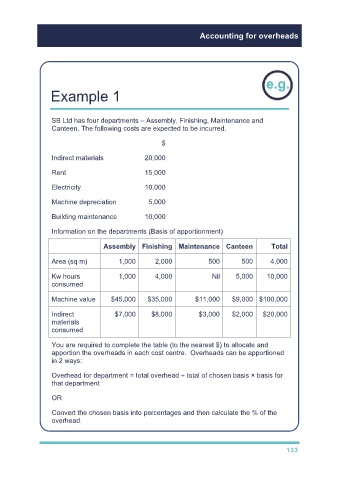

Example 1

SB Ltd has four departments – Assembly, Finishing, Maintenance and

Canteen. The following costs are expected to be incurred.

$

Indirect materials 20,000

Rent 15,000

Electricity 10,000

Machine depreciation 5,000

Building maintenance 10,000

Information on the departments (Basis of apportionment)

Assembly Finishing Maintenance Canteen Total

Area (sq m) 1,000 2,000 500 500 4,000

Kw hours 1,000 4,000 Nil 5,000 10,000

consumed

Machine value $45,000 $35,000 $11,000 $9,000 $100,000

Indirect $7,000 $8,000 $3,000 $2,000 $20,000

materials

consumed

You are required to complete the table (to the nearest $) to allocate and

apportion the overheads in each cost centre. Overheads can be apportioned

in 2 ways:

Overhead for department = total overhead ÷ total of chosen basis × basis for

that department

OR

Convert the chosen basis into percentages and then calculate the % of the

overhead.

133