Page 147 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 147

Accounting for overheads

3.3 Repeated distribution method

When the service cost centres use each other’s services the repeated distribution

method is used for re-apportionment.

As seen in the previous examples the services cost centres were canteen and

maintenance, it is possible that the maintenance staff could use the services of the

canteen and should therefore pick up a share of the canteen’s costs. It is also

possible that the canteen uses the services of the maintenance department and

should therefore also pick up a share of the maintenance department costs. This is

known as reciprocal servicing.

Using the repeated distribution method the service cost centre costs are apportioned

backwards and forwards between the cost centres until the figures become very

small. At this stage it might be necessary to round the last apportionments.

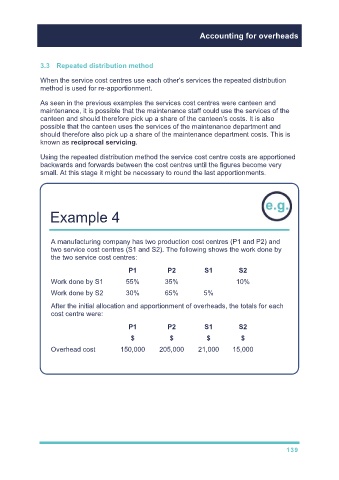

Example 4

A manufacturing company has two production cost centres (P1 and P2) and

two service cost centres (S1 and S2). The following shows the work done by

the two service cost centres:

P1 P2 S1 S2

Work done by S1 55% 35% 10%

Work done by S2 30% 65% 5%

After the initial allocation and apportionment of overheads, the totals for each

cost centre were:

P1 P2 S1 S2

$ $ $ $

Overhead cost 150,000 205,000 21,000 15,000

139