Page 63 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 63

Cost classification

2.2 Classifying cost according to their nature

Direct costs can be clearly identified with the cost object we are trying to cost.

The total of all direct costs is known as PRIME COST.

Indirect costs cannot be directly attributed to a particular cost unit, although it is

clear that they have been incurred in the production of the product.

These indirect costs are often referred to as OVERHEADS.

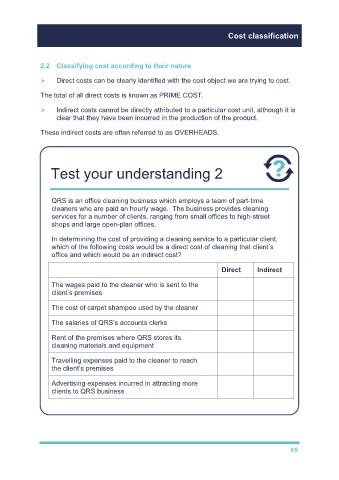

Test your understanding 2

QRS is an office cleaning business which employs a team of part-time

cleaners who are paid an hourly wage. The business provides cleaning

services for a number of clients, ranging from small offices to high-street

shops and large open-plan offices.

In determining the cost of providing a cleaning service to a particular client,

which of the following costs would be a direct cost of cleaning that client’s

office and which would be an indirect cost?

Direct Indirect

The wages paid to the cleaner who is sent to the

client’s premises

The cost of carpet shampoo used by the cleaner

The salaries of QRS’s accounts clerks

Rent of the premises where QRS stores its

cleaning materials and equipment

Travelling expenses paid to the cleaner to reach

the client’s premises

Advertising expenses incurred in attracting more

clients to QRS business

55