Page 133 - Microsoft Word - 00 ACCA F2 Prelims.docx

P. 133

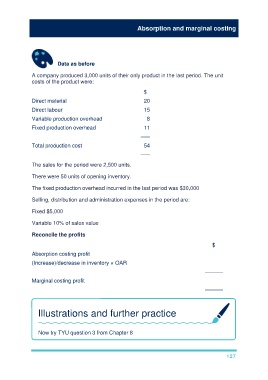

Absorption and marginal costing

Data as before

A company produced 3,000 units of their only product in the last period. The unit

costs of the product were:

$

Direct material 20

Direct labour 15

Variable production overhead 8

Fixed production overhead 11

–––

Total production cost 54

–––

The sales for the period were 2,500 units.

There were 50 units of opening inventory.

The fixed production overhead incurred in the last period was $30,000

Selling, distribution and administration expenses in the period are:

Fixed $5,000

Variable 10% of sales value

Reconcile the profits

$

Absorption costing profit 54,250

(Increase)/decrease in inventory × OAR = 500 × 11 –5,500

––––––

Marginal costing profit 48,750

––––––

Illustrations and further practice

Now try TYU question 3 from Chapter 8

127