Page 156 - Microsoft Word - 00 ACCA F2 Prelims.docx

P. 156

Chapter 9

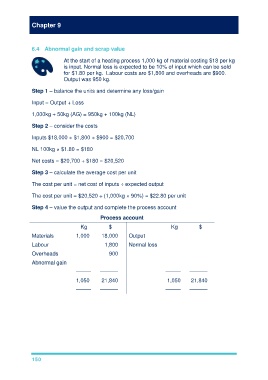

6.4 Abnormal gain and scrap value

At the start of a heating process 1,000 kg of material costing $18 per kg

is input. Normal loss is expected to be 10% of input which can be sold

for $1.80 per kg. Labour costs are $1,800 and overheads are $900.

Output was 950 kg.

Step 1 – balance the units and determine any loss/gain

Input = Output + Loss

1,000kg + 50kg (AG) = 950kg + 100kg (NL)

Step 2 – consider the costs

Inputs $18,000 + $1,800 + $900 = $20,700

NL 100kg × $1.80 = $180

Net costs = $20,700 + $180 = $20,520

Step 3 – calculate the average cost per unit

The cost per unit = net cost of inputs ÷ expected output

The cost per unit = $20,520 ÷ (1,000kg × 90%) = $22.80 per unit

Step 4 – value the output and complete the process account

Process account

Kg $ Kg $

Materials 1,000 18,000 Output 950 21,660

Labour 1,800 Normal loss 100 180

Overheads 900

Abnormal gain 50 1,140

––––– –––––– ––––– ––––––

1,050 21,840 1,050 21,840

––––– –––––– ––––– ––––––

150