Page 10 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 10

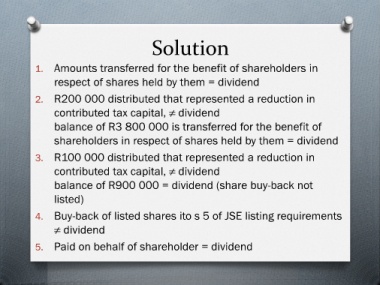

Solution

1. Amounts transferred for the benefit of shareholders in

respect of shares held by them = dividend

2. R200 000 distributed that represented a reduction in

contributed tax capital, ≠ dividend

balance of R3 800 000 is transferred for the benefit of

shareholders in respect of shares held by them = dividend

3. R100 000 distributed that represented a reduction in

contributed tax capital, ≠ dividend

balance of R900 000 = dividend (share buy-back not

listed)

4. Buy-back of listed shares ito s 5 of JSE listing requirements

≠ dividend

5. Paid on behalf of shareholder = dividend