Page 9 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 9

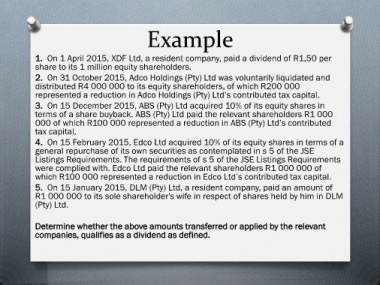

Example

1. On 1 April 2015, XDF Ltd, a resident company, paid a dividend of R1,50 per

share to its 1 million equity shareholders.

2. On 31 October 2015, Adco Holdings (Pty) Ltd was voluntarily liquidated and

distributed R4 000 000 to its equity shareholders, of which R200 000

represented a reduction in Adco Holdings (Pty) Ltd’s contributed tax capital.

3. On 15 December 2015, ABS (Pty) Ltd acquired 10% of its equity shares in

terms of a share buyback. ABS (Pty) Ltd paid the relevant shareholders R1 000

000 of which R100 000 represented a reduction in ABS (Pty) Ltd’s contributed

tax capital.

4. On 15 February 2015, Edco Ltd acquired 10% of its equity shares in terms of a

general repurchase of its own securities as contemplated in s 5 of the JSE

Listings Requirements. The requirements of s 5 of the JSE Listings Requirements

were complied with. Edco Ltd paid the relevant shareholders R1 000 000 of

which R100 000 represented a reduction in Edco Ltd’s contributed tax capital.

5. On 15 January 2015, DLM (Pty) Ltd, a resident company, paid an amount of

R1 000 000 to its sole shareholder's wife in respect of shares held by him in DLM

(Pty) Ltd.

Determine whether the above amounts transferred or applied by the relevant

companies, qualifies as a dividend as defined.