Page 17 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 17

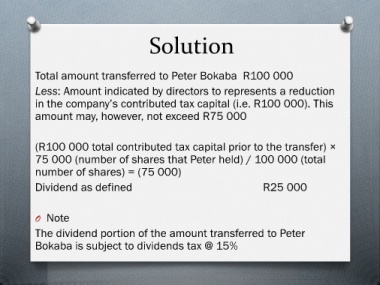

Solution

Total amount transferred to Peter Bokaba R100 000

Less: Amount indicated by directors to represents a reduction

in the company’s contributed tax capital (i.e. R100 000). This

amount may, however, not exceed R75 000

(R100 000 total contributed tax capital prior to the transfer) ×

75 000 (number of shares that Peter held) / 100 000 (total

number of shares) = (75 000)

Dividend as defined R25 000

O Note

The dividend portion of the amount transferred to Peter

Bokaba is subject to dividends tax @ 15%