Page 18 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 18

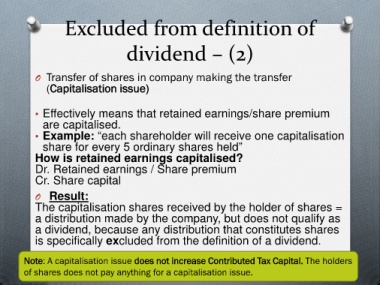

Excluded from definition of

dividend – (2)

O Transfer of shares in company making the transfer

(Capitalisation issue)

• Effectively means that retained earnings/share premium

are capitalised.

• Example: “each shareholder will receive one capitalisation

share for every 5 ordinary shares held”

How is retained earnings capitalised?

Dr. Retained earnings / Share premium

Cr. Share capital

O Result:

The capitalisation shares received by the holder of shares =

a distribution made by the company, but does not qualify as

a dividend, because any distribution that constitutes shares

is specifically excluded from the definition of a dividend.

Note: A capitalisation issue does not increase Contributed Tax Capital. The holders

of shares does not pay anything for a capitalisation issue.