Page 34 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 34

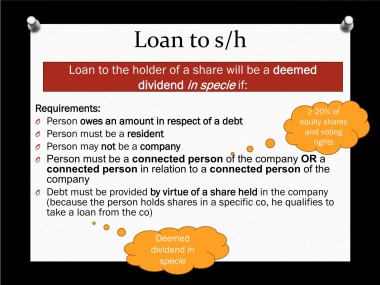

Loan to s/h

Loan to the holder of a share will be a deemed

dividend in specie if:

Requirements: ≥ 20% of

O Person owes an amount in respect of a debt equity shares

O Person must be a resident and voting

O Person may not be a company rights

O Person must be a connected person of the company OR a

connected person in relation to a connected person of the

company

O Debt must be provided by virtue of a share held in the company

(because the person holds shares in a specific co, he qualifies to

take a loan from the co)

Deemed

dividend in

specie