Page 37 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 37

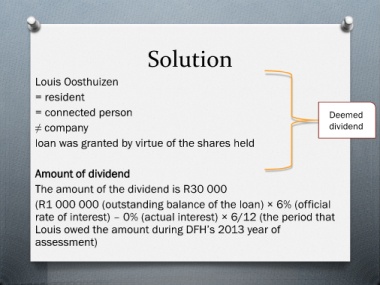

Solution

Louis Oosthuizen

= resident

= connected person Deemed

≠ company dividend

loan was granted by virtue of the shares held

Amount of dividend

The amount of the dividend is R30 000

(R1 000 000 (outstanding balance of the loan) × 6% (official

rate of interest) – 0% (actual interest) × 6/12 (the period that

Louis owed the amount during DFH’s 2013 year of

assessment)